Adverse Media Screening

Create risk profiles of your customers through our specialized Adverse Media Screening solution. It includes 55.000 curated and highly trusted news sources.

Partner Screening

Partner Screening is the necessary basic module on the MCO Pythagoras platform for using Adverse Media Screening.

Credible Sources

AI-supported ClearScan solution from software provider Netlive.

Structured Profiles

Matching with a databank, which contains structured persons- and company profiles.

"We are proud to collaborate with MCO Pythagoras to protect our customers from problematic individuals and organizations. We achieve this by creating a carefully curated Adverse Media List daily."

The key role for a holistic customer perspective

Utilizing Adverse Media Screening brings you one step closer to achieving a comprehensive 360-degree view of your customer.

The global media landscape changes rapidly, and current news seems to announce earlier that customers or other parties have a higher reputation or compliance risk than officially confirmed by conviction.

Our Adverse Media Screening Service is a high-performing Compliance tool that supports companies in anticipating and identifying risks, so they can always be ahead of fishy parties.

Discover the functions of Adverse Media Screening

Tailored to your needs

Developed with six local private and regional banks and focussed on local needs

Daily negative news update

Provides you with a daily updated list of problematic persons and organisations that you can automatically compare with your data.

Edited Artificial intelligence

Credible news Sources

Our adverse media sources are constantly vetted for accuracy and veracity, and are updated daily in real-time to ensure you are ahead of bad actors.

Subscribe and see the Webinar

Learn about current global requirements and how Adverse Media Screenings are done. Follow the arrow to subscribe.

The Advantages of MCO Pythagoras Adverse Media Screening

Reduce your manual effort for adverse media screening with our automated media screening and find problematic customer relationships and transactions at an just-in-time.

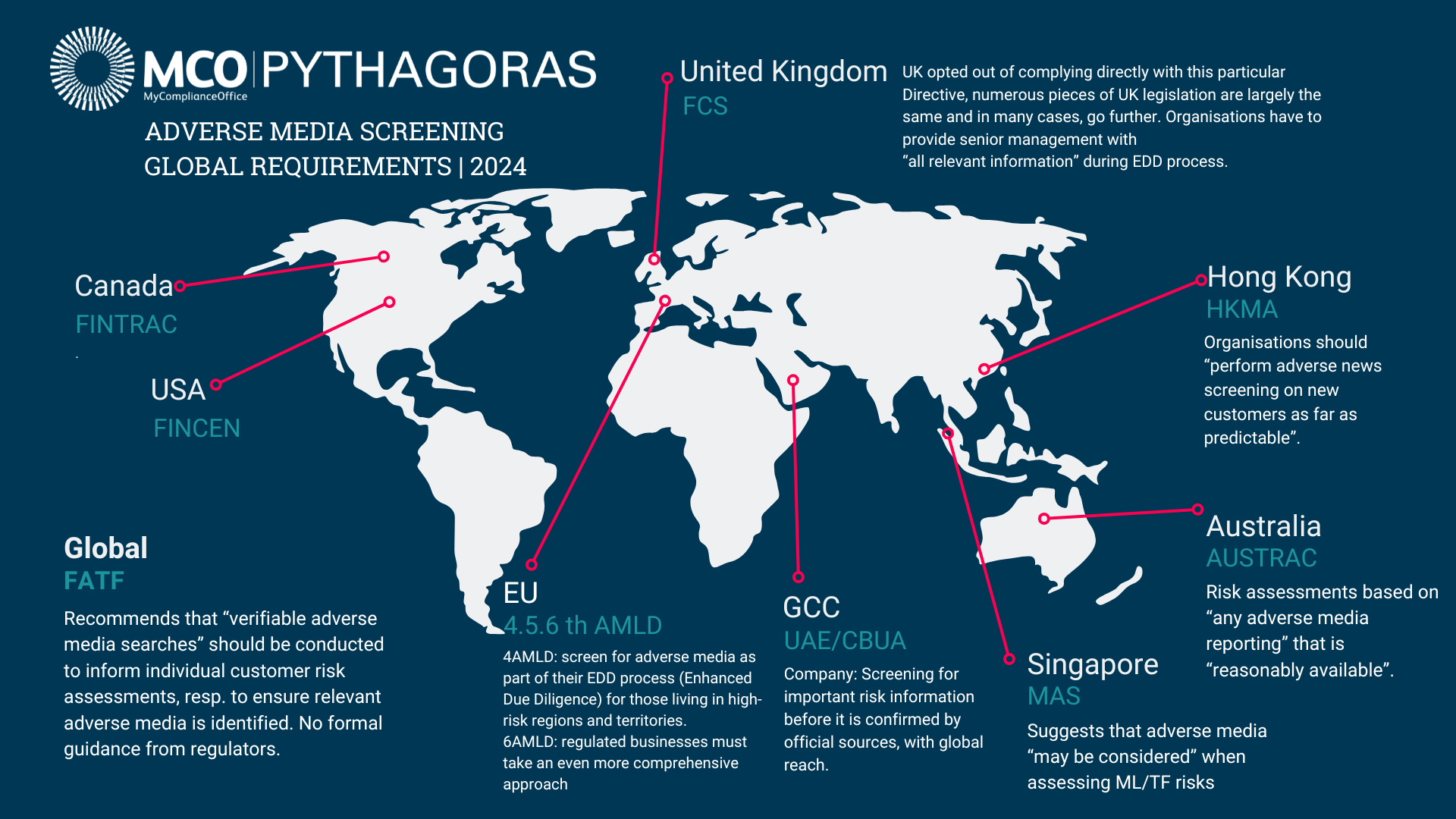

Regulatory authorities around the world require financial institutions to conduct "Adverse Media Monitoring" Adverse Media Monitoring is undoubtedly part of a responsible Know Your Customer (KYC) concept in 2024.

4 Millionen news article are published every day - about corruption, collision and financial fraud, just to name a few. The total from serious media up to politically motivated accusations consolidate in data bases from:

-

traditional news

-

modern media of international organisations

-

Blogs and Webarticle

-

Websites

Correctly assessing the media and relying on the relevant sources is an important factor for successful adverse media monitoring.

Manual checks are time-consuming and tie up resources.

A Google search is no longer enough, as many credible sources only provide their news for a fee. In-house adverse media monitoring requires native speakers, as context is lost in automated translations from certain languages and judges, lawyers and defendants are easily confused.

Distinguishing between trustworthy and untrustworthy media is challenging, and who wants to tell Google and other search engines what their customer portfolio looks like by regularly searching for their own customer names?

THINK COMPLIANCE Insights

What is Adverse Media?

Click the button to read this and more articles on our blog.

Discover more Compliance Solutions

Read THINK COMPLIANCE - Get more Insights

MiCA: The Crypto Compliance Wake-Up Call – Are You Ready for the New Era of Regulation?

Turn AML threats into triumphs. Your shield against fines and violations

AML Risk Management - The human factor in compliance

Cutting-edge technology: mastering the sanctions landscape.

New Zurich Compliance Conference 2025 - proud partner MCO Pythagoras