As global sanctions become more complicated, the need for refined, technologically advanced screening tools has increased.

MCO Pythagoras, a pioneer in compliance software, has developed a state-of-the-art suite of screening solutions. Using advanced analytics, MCO Pythagoras enables an all-encompassing approach to screening, paving the way for global compliance and streamlined, high-quality investigations.

The scope and impact of global sanctions is increasing, making the regulatory environment ever more dynamic. As a result, companies across a wide range of sectors, including industry, financial intermediaries and other industries, are forced to continually scrutinize their customers, trading relationships and operations. This screening involves a growing number of global data sets, including sanctions and politically exposed persons (PEP) lists. A lack of effective screening can lead to severe penalties for sanctions violations and cause serious reputational damage.

Most companies are aware of the seriousness of the situation and focus on partner screening. This important tool enables the identification of high-risk and sanctioned individuals or companies during the initiation process or throughout the duration of the customer relationship.

customer relationship. It is the compliance solution par excellence to screen your business partners.

Understanding the industry challenges of sanctions screening

Navigating the compliance environment requires a thorough understanding of the challenges faced by industries. This complexity spans multiple facets of the sanctions review process, with obstacles arising from an evolving sanctions landscape to operational challenges and issues related to review accuracy.

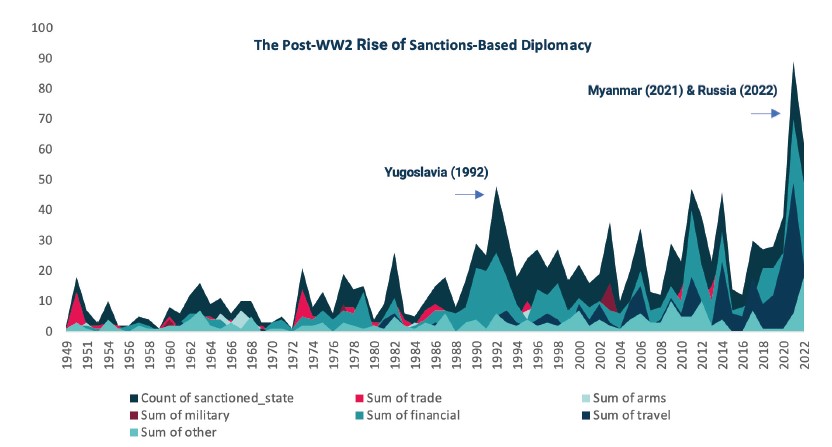

- Dynamic sanctions landscape: With the acceleration of the digital transformation of business activities, the volume of transactions has skyrocketed, complicating the sanctions terrain. In addition, the global data sets comprising sanctions, watch lists and politically exposed persons (PEPs) are in a constant state of flux, driven primarily by geopolitical shifts and changes in legal and geographic frameworks. This incessant evolution presents a complicated challenge as organizations struggle to stay current and remain compliant.

- Operational challenges: The industry also struggles with challenges such as standardizing different lists and data sources, deciding on different writing systems and understanding regional naming conventions. Poor data management and manual data processes exacerbate these challenges, as traditional systems are unable to integrate different data sources and workflows, which in turn reduces efficiency.

- Screening precision deficit: A critical challenge lies in the area of screening precision. The lack of accurate and efficient screening mechanisms poses the risk of false negatives (under-screening), where high-risk individuals or organizations can slip through unnoticed. At the same time, these systems can generate a high number of false positives (over-screening), putting a strain on resources and causing unnecessary delays.

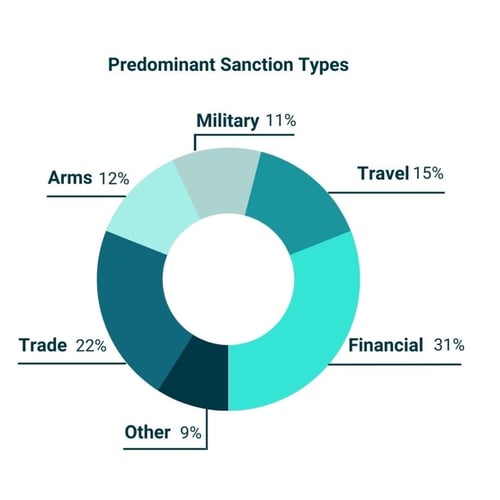

- The rise of sanctions-based diplomacy: The recent wave following the illegal Russian invasion of Ukraine. This conflict alone has led to a significant escalation in global sanctions, particularly on the part of Western nations. The United States and its allies have imposed a series of sanctions to isolate Russia from the global financial system, reduce the profitability of its energy sector and reduce its military edge. These sanctions particularly target the Russian financial sector, the energy sector and the military industry. This rapid increase in sanctions has made the sanctions review process even more complex, as organizations must now navigate an even more intricate web of restrictions and sanctions.

These challenges emphasize the need for a robust, comprehensive and adaptable screening solution. MCO Pythagoras, with its advanced partner screening tool, offers a solution that addresses precisely these industry challenges. By improving the accuracy and efficiency of the screening process, MCO Pythagoras helps the industry minimize risk, ensure compliance and optimize their operations.

The MCO Pythagoras difference - Why choose us?

In an ever-changing regulatory landscape, choosing a trusted partner with a proven track record of delivering effective solutions is critical. MCO Pythagoras offers distinct advantages that position us as an industry leader in the Know Your Customer (KYC) and sanctions screening market:

- Proven expertise: with over 18 years of experience fighting financial crime for leading Swiss financial intermediaries, we have invaluable insight into the complicated world of regulatory compliance.

- Global trust: More than 500 companies worldwide rely on our solutions. This is testament to our commitment to excellence and efficiency in delivering state-of-the-art KYC solutions.

- Industry recognition: Our commitment to quality and effectiveness is recognized in the industry and has made us the market leader in KYC solutions for Swiss financial intermediaries. Comprehensive data integration: We offer comprehensive integration with a variety of global data sources, such as sanctions lists, watchlists, politically exposed persons (PEPs), negative media and other sources associated with increased risks. This integration enables our clients to use the most up-to-date and comprehensive data for their screening processes.

- Comprehensive data integration: We offer comprehensive integration with a variety of global data sources, such as sanctions lists, watchlists, politically exposed persons (PEPs), negative media and other sources associated with heightened risks. This integration enables

our clients to use the most up-to-date and comprehensive data for their screening processes. - Global presence: As a global company, we have offices in South Africa, Hong Kong and several European cities. Our extensive presence allows us to better serve our clients by understanding regional nuances and providing enhanced service through proximity.

With unrivaled experience, global reach and strong data integration, MCO Pythagoras is a trusted partner in sanctions screening.

Navigating the key sanctions authorities: A complex regulatory world

One of the biggest compliance challenges facing the industry is the large and diverse landscape of sanctions authorities. The multitude of these bodies, each with their own sanctions, creates a complex environment that is difficult to monitor and keep up with.

This section provides an overview of the main global sanctions authorities:

- Office of Foreign Assets Control (OFAC): A division of the U.S. Department of the Treasury, OFAC is responsible for administering and enforcing economic and trade sanctions that are aligned with U.S. foreign policy and national security objectives.

- European Union (EU) sanctions: These sanctions are imposed jointly by the member states of the European Union and are instruments to promote common foreign and security policy objectives.

- United Nations (UN) sanctions: These are binding sanctions imposed by the United Nations Security Council to combat threats to international peace and security.

- Her Majesty's Treasury (HM) Sanctions List : This list, maintained by HM Treasury, contains individuals and entities subject to financial sanctions.

- The German Federal Office of Economics and Export Control (BAFA): Is responsible for administering the German national sanctions list and monitoring compliance with sanctions in the federal states.

- State Secretariat for Economic Affairs (SECO): The Swiss authority for economic and labor market policy matters, which includes the administration of sanctions.

- Regional organizations: In addition to these global bodies, regional organizations can also impose sanctions.

Important examples are:

Association of Southeast Asian Nations (ASEAN): this regional organization in Southeast Asia can impose individual or collective sanctions in response to security concerns or violations of ASEAN principles.

African Union (AU): As an intergovernmental organization in Africa, the AU can impose targeted sanctions in response to conflicts, human rights violations or threats to regional stability, the AU can impose targeted sanctions against member states or individuals.

Organization of American States (OAS): This regional organization deals with political, economic, security and social issues throughout the Americas. However, it does not have a comprehensive

system of sanctions.

World map for an overview of the global sanctions management bodies

The complexity of complying with multiple sanctions bodies is compounded by the fact that each body has its own procedures, criteria and enforcement mechanisms. The United Nations, for example, relies on member states for enforcement, and there is evidence that enforcement of UN sanctions is often weak due to limited resources and political incentives in some member states.

Similarly, European Union sanctions that are not decided by the member states are mainly implemented by the member states themselves.

The EU Commission monitors the application of Union law and ensures uniform application of sanctions across the EU, but the main responsibility for implementation and detection of violations lies with the Member States. The United States, which applies more economic and

and financial sanctions than any other country, also has its sanctions programs administered by the Treasury Department's Office of Foreign Assets Control (OFAC). Other departments, including State, Commerce, Homeland Security and Justice, can also play an important role. The process of imposing new sanctions or modifying existing ones can originate in both the executive and legislative branches, which can sometimes lead to conflicts in sanctions policy.

This complexity underscores the importance of a robust compliance program that can navigate the intricacies of the various sanctions regimes. It is critical to keep abreast of the latest sanctions lists, understand the specific requirements of each sanctions body and have systems in place to ensure compliance.

Understand industry trends: A shift towards a complex compliance landscape

Ongoing industry trends are adding a new level of complexity to sanctions compliance. This section provides an overview of the key industry trends shaping the sanctions landscape:

- Broadening the target groups of sanctions: Sanctions are no longer limited to specific individuals or companies, but encompass entire sectors or prohibited activities. This expansion of scope and impact adds a new level of complexity to sanctions measures.

- Extraterritorial application of sanctions: The reach of sanctions extends beyond the borders of the imposing country. Foreign companies or individuals conducting transactions with sanctioned parties may also be subject to sanctions, making global compliance with sanctions a difficult endeavor.

- Cooperation and coordination: There is a visible increase in cooperation and coordination between countries and international bodies in the imposition and enforcement of sanctions. This trend serves to address common threats and concerns, but also demands more from companies to remain compliant in all jurisdictions.

- Narrative and sectoral sanctions: The emergence of narrative and sectoral sanctions no longer only targets specific companies, but now also covers specific sectors and prohibited activities. This change leads to a greater degree of freedom of interpretation and requires a more nuanced understanding and better decision-making in implementation.

- The extended scope of sanctions: The impact of sanctions extends beyond the companies primarily sanctioned. They can also be applied to companies they own or control, as well as to customers associated with them. This necessitates a comprehensive risk assessment and mitigation strategies in compliance programs.

Recognizing and understanding these trends is critical to aligning your compliance strategy. Pythagoras can help your organization stay ahead of these complexities and ensure compliance in a rapidly evolving sanctions landscape with its Partner Screening Tool.

Integrated solutions for global sanctions screening: Pythagoras at the helm

Pythagoras offers a comprehensive, integrated solution for global sanctions screening with the Pythagoras Partner Screening tool.

This application, equipped with proprietary, industry-leading data quality and matching technologies, helps companies minimize false positives and reduce the risk of overlooking true matches. It facilitates efficient and effective screening of customers, vendors, beneficial owners, etc., both during onboarding and ongoing operations.

By screening and blocking suspicious transactions in real time, the application helps companies to effectively minimize risks while optimizing the efficiency of the compliance team. It also enables companies to cost-effectively manage the increasingly complex national and international sanctions landscape and regulatory compliance.

Overview: Pythagoras Partner Screening simplifies the risk assessment of business relationships by using state-of-the-art technology to automate the screening process. It provides real-time risk monitoring and integrates Native Character Screening to handle non-Latin characters to ensure global compliance. The main strength of the system lies in the automation of matching against internal and external reference data, reducing the workload for the KYC compliance team.

This allows the team to focus on managing important cases and strategic decision making, while complex risk profiles can be analyzed efficiently. With Pythagoras Partner Screening, your organization can expand globally while complying with local regulations without compromising on the quality of the risk assessment.

The most important advantages

- Secure: Guaranteed data security thanks to local installation.

- Reliable: A sophisticated search engine and configurable settings help to reduce the error rate.

- Transparent: Screening rules can be adapted to the respective legal system.

- Customizable: Segmentation according to risk groups.

- Optimized: Streamlined case management based on extensive practical experience.

- Fast: Quick implementation and user-friendly.

- Traceable: Complete audit trails and tamper-proof history.

Key features

![]()

Complete: Extensive data synchronization and automatic updates.

![]()

Customized: Personalized checking rules and data filters (sanctions, PEP screening, etc.)

![]()

Analytical: Diagnostic tools for matches and a configurable scoring algorithm.

![]()

Multilingual: Native Character Screening supports more than 30 non-Latin characters.

![]()

Flexible: Ad-hoc queries, warning rules, detailed data segmentation and user management.

![]()

Pythagoras Name Check: A browser-based module for quick name checks, available to a large user base on your company's intranet.

Integrative: Comprehensive API support for seamless integration into automated processes and workflows, offering a wide range of possibilities to increase efficiency and automation.

Partner Screening - The process of updating data

Use case in industrial production: screening of sanctions in the production and processing industry

The challenge: Identifying sanctioned business contacts

The manufacturing and processing industry, like many other industries, is faced with the complicated task of ensuring compliance with sanctions.

In order to comply with the relevant regulations, companies in this sector are required by law to check their business partners against national and international sanctions lists.

Determining whether a business contact is sanctioned is a major challenge.

It requires meticulous verification measures and an extensive comparison with publicly available sanctions lists. This process is not only time-consuming but also complex, as sanctions regulations are constantly evolving. Nonetheless, it is an important endeavor to ensure compliance and mitigate the risk of severe penalties.

Pythagoras' Partner Screening solution enables a systematic review of business relationships to identify potential risks associated with individuals or organizations.

It automates the comparison with external and internal reference data and thus relieves the compliance teams so that they can concentrate on case management. In addition, the Pythagoras Partner Screening solution integrates Native Character Screening, which supports non-Latin characters. This feature ensures global applicability while complying with local requirements.

The solution is characterized by its comprehensive coverage of global data sources, including sanctions lists, PEPs and regulatory watch lists. They include analysis and data quality processes to minimize false positives and increase efficiency. The solutions offer a configuration that allows organizations to tailor screening routes and data filters to their specific requirements.

The future of sanctions: Emerging trends

As we look to the future, emerging trends in sanctions will further complicate compliance. Some of the key trends you should consider include:

- Technological advancement: as technology rapidly advances, sanctions are also evolving to address new threats in the digital realm. Cyber activities such as hacking, cyber espionage and interference in democratic processes are increasingly subject to sanctions. As these digital threats become more sophisticated, the tools and strategies that companies use to identify and mitigate potential sanctions risks must also be adapted.

- Improved compliance measures: Regulatory expectations for sanctions compliance are increasing. Financial institutions and companies are expected to implement robust compliance programs, conduct enhanced due diligence and use sophisticated screening technologies to meet these regulations. Increased scrutiny from regulators means that companies must constantly reassess and improve their compliance measures to avoid falling foul of ever-evolving sanctions rules.

These trends point to a future where sanctions compliance will be a more complex and technically challenging endeavor. To overcome these challenges, companies need to harness the power of advanced technologies and smart solutions. With the right tools, such as Pythagoras' comprehensive, integrated solution for global sanctions screening, these companies can navigate the complex sanctions landscape with confidence, ensuring their business operations remain compliant and their reputation is safeguarded.

Key findings

The complex and rapidly evolving global sanctions compliance landscape presents a multi-layered challenge for organizations across all industries. However, by utilizing advanced technologies, such as Pythagoras' Partner Screening application, companies can effectively navigate this terrain and ensure full compliance.

Pythagoras' Partner Screening application provides an end-to-end solution that enables accurate, enterprise-wide watchlist processes, multi-country screening and integrated, high-quality investigations. This comprehensive approach maximizes your return on investment and provides the following key benefits:

1. comprehensive global sanctions screening across the entire customer lifecycle: the application provides real-time and batch screening capabilities against a wide range of data sources, including global sanctions, politically exposed persons (PEPs), regulatory watchlists, ultimate beneficial owners (UBOs), negative media and internally managed lists. Crucially, this screening is not limited to onboarding or periodic reviews, but takes place at multiple touchpoints throughout the customer lifecycle.

2. high quality data and flexibility: The application offers best-in-class data quality and matching capabilities. It deftly handles typos, misspellings, nicknames, titles, prefixes, suffixes, qualifiers, concatenations and transliteration restrictions to ensure accurate recognition. The transparent matching engine provides flexibility in matching, allowing financial institutions to optimize the system to their specific requirements.

3. reduction of false positives and labor: The application is equipped with a matching engine focused on the quality of the company's data and uses advanced data preparation techniques and a unique matching process. This approach leads to matching results even with incomplete, inconsistent or erroneous data. Consequently, the system significantly reduces the number of false positives, optimizing the time and resources spent on investigations. In summary, the industry faces major challenges when it comes to navigating the complicated world of sanctions compliance. With Pythagoras' Partner Screening application, these industries can not only overcome these challenges, but also maximize their return on investment (ROI). With a comprehensive, accurate and flexible solution, Pythagoras provides the tools necessary to ensure compliance with the dynamic landscape of global sanctions.

The system ensures the accuracy of reconciliation results, even with incomplete, inconsistent or erroneous data. Consequently, the system significantly reduces the number of false positives, optimizing the time and resources spent on investigations.

In summary, the industry faces major challenges when it comes to navigating the complicated world of sanctions compliance.

With Pythagoras' Partner Screening application, these industries can not only overcome these challenges, but also maximize their return on investment. With a comprehensive, accurate and flexible solution, Pythagoras provides the tools necessary to ensure compliance with the dynamic landscape of global sanctions.

Stay informed.

We'll keep you up to date with the latest news, important information, helpful tips and valuable articles.

%20%E2%80%93%20Definition%20und%20Relevanz.jpg)